Have you ever asked – what are the tax benefits of moving to Portugal? This question comes to mind especially if you’ve been told that the Portuguese tax system is one of the most generous in Europe. It’s also a common reason people decide to move to Portugal from the US, UK, and other parts of the world. That said, it’s reasonable to want to know the tax benefits of moving to Portugal and how they might apply to your unique situation. Here in this article, we’ll talk about the favorable tax rates and incentives that Portugal offers.

What are the Tax Benefits of Moving to Portugal?

1) Tax treaties

First off, if you’re classed as a tax resident in Portugal, your worldwide income may be subject to Portuguese income tax. This often includes rental income, salary, and capital gains. Yet, Portugal has tax treaties with other countries like the UK, which means you won’t have to pay more than one tax on any income in multiple jurisdictions.

2) Lower inheritance taxes

If you plan to gift your children a Portuguese estate, there will be no inheritance tax. However, they’ll still have to pay a 10 percent stamp duty (Imposto do Selo).

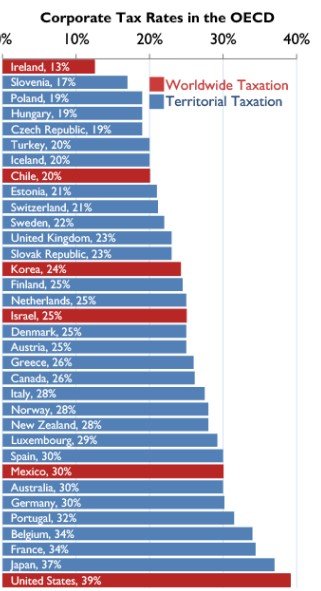

3) Affordable taxes for owing businesses in Portugal

Corporate businesses in Portugal pay a flat rate of 21 percent on any taxable profiles. However, there are applicable local municipality charges up to 1.5 percent. Small and medium-sized businesses pay a 17 percent rate on their first 15,000 Euros of taxable profit before the regular corporate fees apply. However, small businesses and sole traders earning less than 200000 Euros a month pay a simplified regime turnover instead of profit. Qualified startups also pay a preferential rate of 12.5% as well. These tax structures enable businesses across Portugal to scale with much ease.

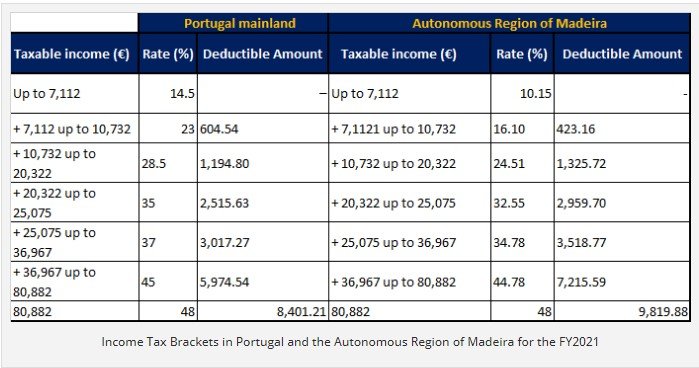

4) Reduced tax rates in the Autonomous regions of Madeira and Azores

If you’re moving to Azores or Madeira, you’ll also enjoy significantly more reduced taxes. For instance, the Madeira International Business Center of Madeira (IBC) offers some of the most advantageous tax regimes within the European Union. Companies within the IBC benefit from a reduced corporate tax rate of 5%, which is applicable until the end of 2027.

However, this applies mostly to businesses offering international services and manufacturing profits. There’s also no withholding tax on interest, royalties, and dividends paid to non-resident entities. However, you should also factor in the stamp duty, real estate transfer tax, and other local taxes that might apply. Regardless, Madeira offers some of the most attractive fiscal benefits to Businesses within the European market.

5) Reduced taxes under the NHR scheme

Foreign residents in Portugal have for several years enjoyed the Non-Habitual Resident (NHR) regimen, which allowed them to enjoy tax-free transactions and low taxes on pension income and wealth. Specifically, the special tax status exempted taxes on foreign-sourced income and a flat 20 percent tax rate on incomes earned from Portugal.

Also as a foreign resident in Portugal, you paid lower taxes on property earned incomes. These exemptions also applied for up to 10 years.

However, the NHR regime came to an end in January 2024, meaning that any tax resident in the country in 2023, who had not been taxed in Portugal in the previous five years could still apply till March 31, 2024. That said, some individuals can still take advantage of the NHR scheme up to March 31, 2025, if they meet the following requirements:

- An employment contract that was signed or to be signed by December 31, 2023.

- A lease agreement or other contract for the use and possession of property signed by October 10, 2023.

- A contract to buy property in Portugal was signed on October 10, 2023.

- Kids enrolled or registered in a school in Portugal by October 10, 2023.

- Residence visa or residence permit valid until December 31, 2023

- Application for a residence visa or residence permit initiated by December 31, 2023

- Being a member of a household meeting any of the above requirements.

6) Reduced tax rates under the NHR replacement scheme

If you were not tax residents previously in Portugal (for the previous five years) then you could qualify for the new NHR replacement. The new program is called the Incentivised Tax Status Program (ITS) or Tax incentive for Scientific Research and Innovation. Specifically, it targets people from certain professions moving to Portugal.

Those who qualify will be eligible for a 20 percent flat rate on eligible professional income from Portugal, and possible exemption from any foreign-sourced income. These exemptions may apply to capital gains, rent, interests, dividends, and more. However, unlike the previous NHR program, it does not exclude pensions. Again the benefits will last up to 10 years.

Specifically, people who apply include

- Teachers and scientists

- People with qualified jobs according to the tax code and members of corporate bodies within the scope of contractual benefits for productive investment including:

- Tourism including activities of interest to tourism

- Activities carried out within the scope of the extractive industry and manufacturing industries

- Agricultural, fish farming, aquaculture, farming, and forestry activity

- Research, and development, and high technological intensity activities

- Defense, environment, energy, and telecommunication

- IT and related activities and services

- Activities of shared service centers

- People working for startups certified by law

- Research and development personnel meeting definitions of tax code.

- People working for companies recognized by relevant government agencies such as IP, IAPMEI, EPE, or other relevant bodies.

- People working for startups, certified by law

- People working in the Azores and Madeira meeting terms set by respective regions.

- Highly qualified professionals or anyone performing activities listed above.

Also, note that Portugal recently swore in a new government. And the new government has promised to look into more attractive incentives for foreigners. So stay tuned!

How to Apply for a Tax Number in Portugal

Before moving to Portugal, you must know that you’ll need to register as a taxpayer. You must do this before you can conduct any paid activities within the country. Registering requires first obtaining the NIF (Numero de Identicacao Fiscal) which can be obtained from a local tax office.

That said, the Portuguese tax year follows the calendar year and ends on December 31st.

Other Great Benefits of Relocating to Portugal

Portugal has numerous exciting opportunities that have made many people continue vying to relocate to the country. The Portuguese golden visa program is one such, although it’s getting some restructuring soon.

Great visa options with reasonable requirements

As expected, every country has a variety of visas for different people, each having its requirements. Portugal isn’t left out. And yet, you’ll find that many such have decent requirements. The D7 visa is one of the most popular, considering how you only need to have a passive income that equals the Portuguese minimum wage. There are also short-stay and long-stay Digital Nomad visas, alongside D2 Startup visa options.

Cost of living

The cost of living in Portugal is also fairly low when compared to countries like Germany, France, Scotland, and Spain. It’s no wonder, Portugal is one of the most affordable countries in Western Europe.

Stable Financial Climate

Portugal’s tech and alternative energy industries are booming, creating demand for skilled workers in applicable professions. Plus, the services industries cutting across construction, tourism, and administrative support are all growing too. However, you should note that tourism and hospitality, although in great demand have seasonal jobs. Regardless, the country has been witnessing some economic boom, giving you that advantage when you move there.

Tips to Take Advantage Of Portugal’s Affordable Taxation

-

Get a tax professional

Depending on your finances, types of businesses, and everything else, you might need advice from tax experts. For instance, if your country has “worldwide taxation” rules (e.g. US), you’ll need to figure out your taxes in both your home country and Portugal. Nevertheless, Portugal offers attractive tax benefits which are advantageous in all scenarios, especially when you plan well in advance.

-

Consider living costs

Portugal is affordable, but not dirt cheap as most people assume. Places like Lisbon and Porto have higher rent prices and real estate values than other regions. So you need to consider all applicable living costs, depending on the lifestyle you want to have when you move there. A good data analytical tool that helps is Numbeo’s cost of living calculator.

-

What would retirement be like?

Are you nearing retirement? Are you retired already? Do you wish to grow old in Portugal? All these influence your tax situation, and pension. Estate planning would be one crucial area. There’s also considering your health insurance and more.

Concluding Thoughts

So what are the tax benefits of moving to Portugal? You can enjoy attractive benefits as ex-pats under the new Incentivized Tax Status Program). These taxes significantly increase if you are a highly specialized professional or opening a business in Portugal. Also, Portugal has a lower cost of living and many visa options with reasonable requirements.

You’ll also love that it’s a stable and growing economy, creating tons of opportunities for you. Looking at all of these benefits, there’s no need to tarry when it’s much better to move to a magnificent country like Portugal. Still, always consult your immigration lawyer and tax experts to help you figure out how these incentives apply to you.

Frequently Asked Questions About Tax Benefits of Moving To Portugal

Is Portugal a good tax haven?

Portugal isn’t a classic tax haven with super low rates for everyone. However, it offers attractive tax benefits for certain residents through the Non-Habitual Resident (NHR) program and the Incentivised Tax Status Program (ITS). This program can be appealing for some, but Portugal cooperates with international tax authorities so it’s not suited for hiding income.

Does Portugal tax US income?

It depends. Residents of Portugal are generally taxed on their worldwide income, including US income. However, the NHR and Incentivised Tax Status program can exempt certain types of foreign income, including pensions and investment income, for qualified residents.

Are property taxes high in Portugal?

Property tax rates in Portugal vary depending on the property type and location. They generally aren’t super high. However, there can be additional property ownership taxes. It’s best to speak to an immigration lawyer or property expert before venturing into the real estate scene in Portugal.

Does Portugal tax retirement income?

Portugal generally taxes all income including retirement income. This includes both government and private pensions. The NHR program used to exempt this for 10 years. However, the NHR program came to an end in 2023.

Do non-residents pay tax in Portugal?

Non-residents are generally taxed on income arising in Portugal. This includes income earned while working in the country or rental income from Portuguese properties. The tax rate also depends on your unique situation.

Why is Portugal good for expats?

Portugal has diverse advantages for expats such as a warm and sunny climate, beautiful scenery, relatively low cost of living, significant tax benefits, and quality healthcare.

Which country in Europe has the lowest tax rate?

Several European countries compete for the lowest tax rates. However, Bulgaria and Romania have 10% flat income rates, while Hungary (15% top rate), Estonia (20% top rate), and the Czech Republic (23% top rate) all also boast among the lowest tax rates as well.

Can you live tax-free in Portugal?

No, Portugal doesn’t offer a complete tax exemption for residents. However, they do have a program with significant benefits.

Can you avoid capital gains tax in Portugal?

Not entirely, but Portugal offers some capital gains benefits and they are taxed at a flat rate in Portugal. There can be exemptions or reduced rates for specific situations, like reinvesting capital gains into certain assets. But always consult a tax professional for personalized counsel.